Apple Search Ads Cost: CPT, CPA and CR Benchmarks 2022

Gabriel Kuriata

Gabriel Kuriata

Gabriel Kuriata

Gabriel Kuriata

How to be certain that your Apple Search Ads search results campaigns are reaching their true potential and costs of campaigns remain firmly under control? At SplitMetrics, we know that the evaluation of your Apple Search Ads performance is much easier with industry benchmarks at hand. This is why we always keep our finger on the pulse of the mobile app market, analyzing millions of app downloads, keywords, and billions of impressions. Our analysts provide regular overviews of the main Apple Search Ads metrics: TTR, CR, CPT and CPA, along with market insights from the mobile industry leaders.

This article is an easy digest of our Apple Search Ads Search Results Benchmarks Report, for the second half of 2022. Besides values of costs per tap (CPT), tap-through rates (TTR), costs per acquisition (CPA) and conversion rates (CR), it offers insights into macro-trends influencing them. Additionally, we shed some light on the interesting topic of measuring cost per actual install (CPI) and discuss managing Apple Search Ads.

All data presented here comes from our Apple Search Ads Search Results Benchmarks Report. They were aggregated with our Apple Search Ads management platform, SplitMetrics Acquire.

Benchmarks are a key tool for marketers in setting realistic or more ambitious expectations for their campaigns. Our benchmarks come from thousands of search results campaigns run with SplitMetrics Acquire, an Apple Search Ads managements & optimization platform, that unites the best performing and most successful apps available on the App Store. Take our benchmarks as guidance and set your app on a path to success. How to access all the data that we have to offer?

For the latest figures, we recommend keeping an eye on our benchmarks dashboard, updated in real time. Use our dashboard as an everyday reference tool for configuring your campaigns.

For a more in depth look, both data and tips & tricks from the industry’s experts, check out our most recent benchmark report:

To see how the App Store environment evolved over the years, check out our past reports on ads in search results:

In 2023, we’ve released a report for a new placement: product page ads! Find out more about them and how they can fit in you multi-placement Apple Search Ads campaigns.

To answer this mobile app marketing benchmark question and uncover average CPT, CPA and TTR by app categories, for the last two quarters of 2022 we analyzed:

In order to help you understand these numbers better and optimize your Apple Search Ads for the best results, we’re also sharing key factors that determine Apple Search Ads price and – what’s even more important – our tips for managing your App Store Ads cost and performance.

Since in Apple Search Ads you’re paying for nothing but taps on your ads, let’s start with the average CPT.

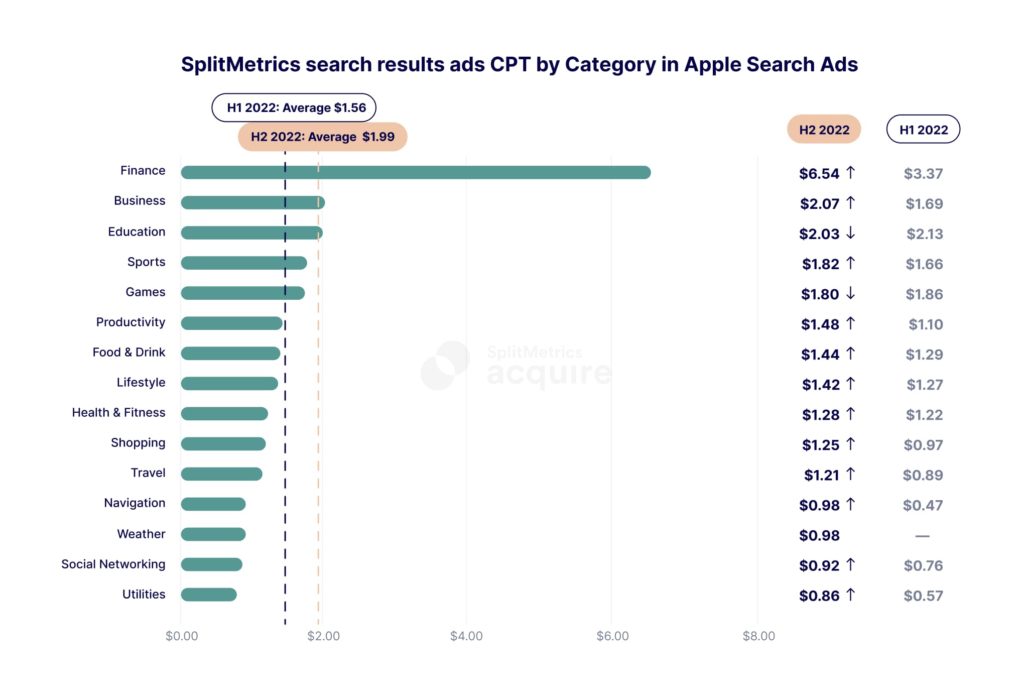

In the second half of 2022, the average cost per tap of Apple Search Ads amounted to $1.99 for Search results campaigns. Costs per tap for top 15 categories are shown on the chart below:

Finance was the most expensive category, with CPT reaching $6.54. An increaase from $3.37 in H1.2022. Business and Education followed, with average CPTs standing at $2.07 and $2.03 respectively, meaning that only these three categories crossed the average cost of $1.99 per tap. Overall, compared to the data from the first half of 2022, we can observe that despite some reshuffling, traditionally expensive categories maintained their top spots.

The value of CPT (and the App Store advertising cost in general) is driven by competitive bidding, not the number of apps. This is the nature of all auction based platforms. Finance is an excellent example of this mechanism: although the $6.54 average CPT may seem high, it pales in comparison to $11.73, driven in 2021 by a boom in the cryptocurrency segment that went as quickly as it came, in a category that shares less than 5% of the App Store’s apps.

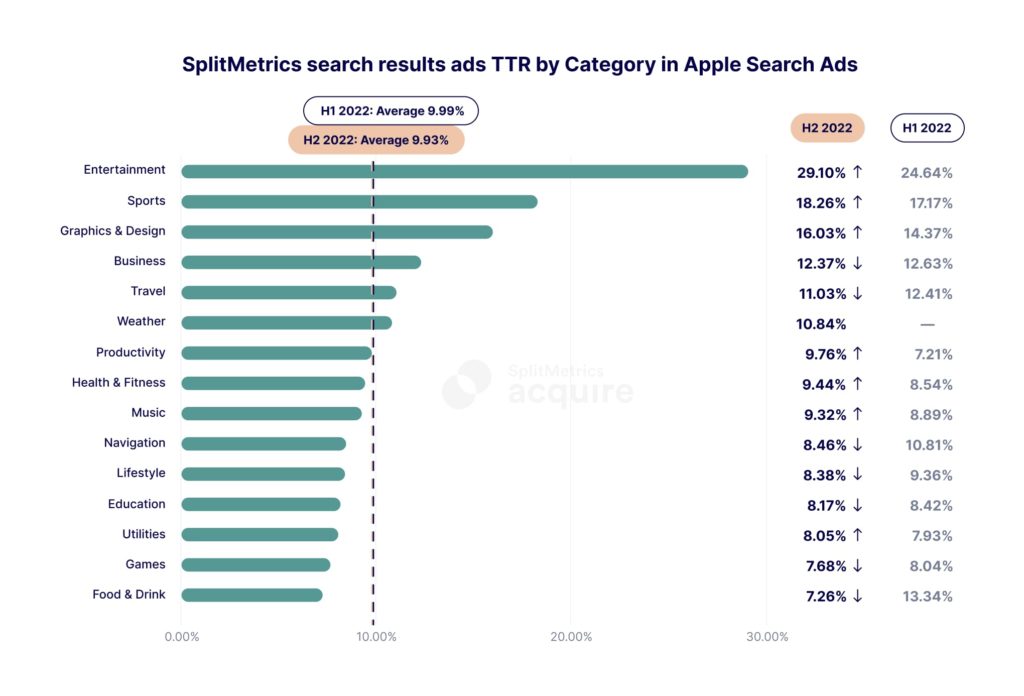

What factors matter when it comes to tap-through rate? Well, it’s complicated. Early conversion experiments with Apple Search Ads had shown that average users didn’t understand that they dealt with an ad and behaved like organic users would, providing a high tap-through rate (a result of the striking visual similarity between Apple Search Ads and organic results). However, our studies of TTR’s in following years in Apple Search Ads have repeatedly shown that users recognize and even sometimes ignore paid ads, focusing on organic results. It’s clear though that more factors are at play when you look at the chart below:

The average tap-through rate amounted to 9.93% in H2 2022. Entertainment topped the ranking for the entire year, with an outstanding 29.10% TTR, followed by Sports (18.26%), Graphics & Design (16.03%), Business (12.37%), Travel (11.03%) and Weather (10.84%), all of them sitting above the first half’s average TTR of 9.93%.

To wrap up past and present findings, here are the most important takeaways from these figures:

All in all, the most important lesson is this: know your user and app category. Motivations and user journeys vary so significantly between them that we have to know as much as possible about them to succeed. Also, seasonality matters for many categories.

Our real-time Apple Search Ads Benchmark Dashboard it’s the best way to track fluctuating metrics in day-to-day work.

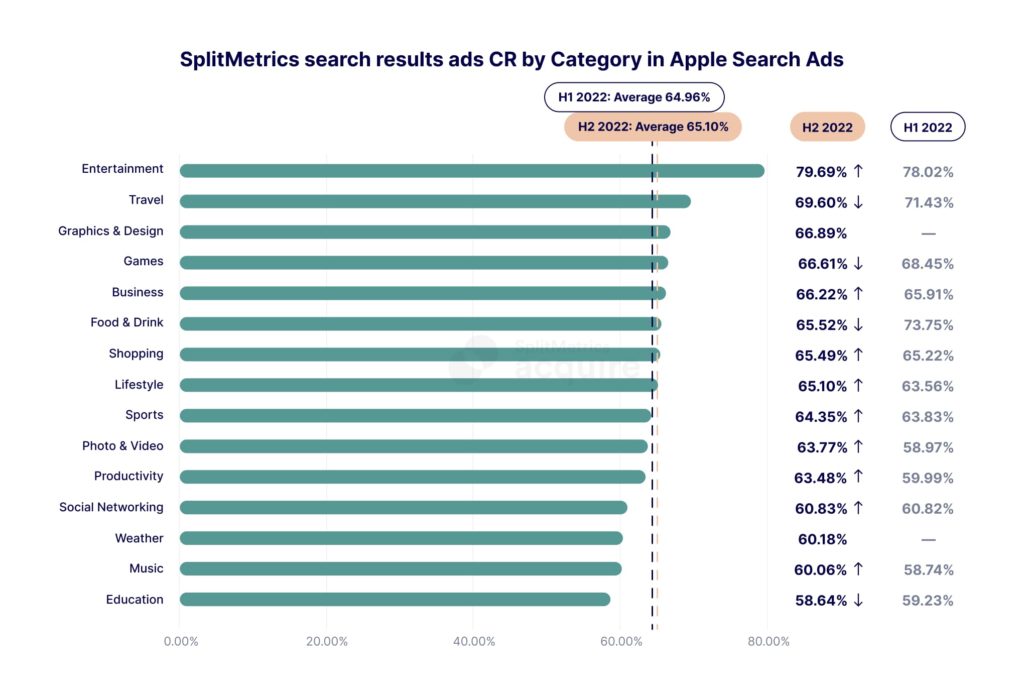

Conversion rates reflect the likelihood of the user tapping the “GET” button after visiting your product page on the App Store (or in some instances, directly after searching). The value of this metric can vary greatly between categories as shown on a chart below:

The average conversion rate for the second half of 2022 was 65.10%, only a slight increase from 64.96% observed for the first six months.

These figures are yet another example of how important it is to understand user behavioral patterns and intent for a given app category.

Take Finance, the top category in terms of CPT and CPA, but not even within the top 15 for conversion rate and tap-through rates. It shows clearly that high user acquisition costs aren’t just a result of tough competition, but also reflect each category’s unique customer’s journey. While we may quickly install a “try for free” game (leading to high conversion rates for this category), it’s reasonable to assume that we must do more to reaffirm people landing on our product page that our Finance app solves their problem.

The Entertainment category deserves a closer look, because of its incredibly high (79.69%) average conversion rate, which somehow managed to grow from H1’s 78.02%. This might be the enduring effect of the pandemic which prompted more people to escape their worries with the help of mobile apps. In addition, some truly powerful brands make up this category, which might be reflected in the high intent of search queries.

All these differences in customer journeys and category specifics show how important app store optimization strategy truly is.

That’s why before app marketers start investing in Apple Search Ads, it makes sense to optimize their product pages. Mobile A/B testing with SplitMetrics Optimize is one of the most efficient and trustworthy ways to do it. Only by perfecting all store page elements, app publishers are able to make the most of Apple Search Ads.

The example of the Game category proves it. This App Store segment is famous for its extreme competition which makes game publishers take care of their product page optimization. Thus, optimized store pages of games mitigate the impact of high CPT.

Alright, it’s time to learn another highly important mobile app marketing metric – how much you pay for one acquired user.

Cost per Acquisition (CPA) is the mobile app marketing metric that indicates how much you pay for every “GET” button tap.

CPA plays a special part here as every mobile marketer aims at achieving a low cost per acquisition. But, how low is low enough when it comes to this mobile app marketing metric? What costs per tap and install should you expect when working with Apple Search Ads?

The average cost per acquisition was $3.21 in the second half of 2022, a significant jump from $2.40 in the previous six months.

Finance apps are responsible for this boost, as yet again topped the chart with an outstanding $11.34 CTA (up from $5.54 from H1 2022). The next in line Education reached $3.46. Business landed on the third place with $3.12, with Sports and Gaming closing the “above-the-average” podium with $2.82 and $2.70 respectively. Overall, save for a sudden cost increase for Finance, no noteworthy changes took place in the top, most expensive categories.

In the context of CPA, we need to discuss one last metric: Cost Per Install (CPI). CPI isn’t a part of the core Apple Search Ads platform, but functions in the SplitMetrics Acquire ecosystem.

In Apple Search Ads, installs are equated with downloads, or rather the instance of a user tapping the “GET” button, which doesn’t have to result in a physical installation of an app. Connectivity issues or other errors can interrupt the installation process and thus lead to data discrepancy. The “traditional” CPA doesn’t account for reinstalls from already acquired users or instances where the app wasn’t even opened after installation.

We see it in our data: the number of app page visitors who tap “Get” differs from the number of visitors who eventually install the app. Therefore, the actual CPI can be higher than CPA.

This is why in our platform SplitMetrics Acquire we allow for customization of how installation is defined. In essence, it can be any in-app event that you think will best reflect the final step in the acquisition process. Installation can be counted when the user opens the app or even performs a specific action, like registering an account or launching certain features. We acquire this information thanks to our integration with various MMP, responsible for in-app behavior analytics.

In any case, for the purpose of our report “Apple Search Ads Search Results Benchmarks Report” for the second half of 2022 we used data from the App Store for consistency. Just remember what this official metric actually represents and that there are custom alternatives that can and will help you analyze acquisition costs in the context of your business goals.

You can read more about optimizing your campaigns for installs in this whitepaper.

Should you decide that a customized approach to calculating CPI best reflects your business model and monetization plan, connect the app attribution system from your Mobile Measurement Partner (MMP, like AppsFlyer, Branch, Adjust, Kochava, TUNE, etc.) with SplitMetrics Acquire, an Apple Search Ads optimization platform, and see the App Store ads performance on all levels in one place. It can be a very simple process that doesn’t have to involve any additional IT resources. SplitMetrics is actively cooperating with various mobile measurement partners and their systems are prepared for a quick, integrated startup.

Is the average $3.21 Cost per Acquisition low or high? Given the large differences between categories, it makes more sense to assess CPA individually for each one of them.

App Store advertising cost is determined entirely by app publishers. Apple Search Ads functions on an auction basis, which means that the price you pay for a tap is the bid of your closest competitor + $0.01. The more competitors there are and the more aggressive their bidding is, the higher the Apple Search Ads price.

Before joining a big auction and competing with other advertisers on Apple Search Ads, it might be also great to look at key factors that determine Apple Search Ads cost and learn how to adjust the CPT you’re getting to your mobile app marketing goals.

Know your audience, category and competitors. The relevance score of Apple Search Ads ensures you compete only with relevant applications. It is likely that these applications will be from the same category and weight class as your app.

This way, Apple eliminates CPT bid peaks and provides conditions for a fair competition for app publishers. Analyzing benchmarks for categories relevant to your app should definitely become a part of your mobile app marketing strategy, as it translates directly into your ability to predict and control Apple Search Ads pricing.

Check the Guide on how to reduce CPA and CPI for your mobile app here.